There’s also other synergies, I think what you’re referring to as corporate synergies, which is more about giving me more power in the market. So again, think of those patents and machinery and teams and people I mentioned earlier.

We distinguish in the paper between network synergies and internal synergies, which come from combining assets that you and I own and control internally. How they’re different from other kinds of synergies is also important. We call those benefits network synergies.

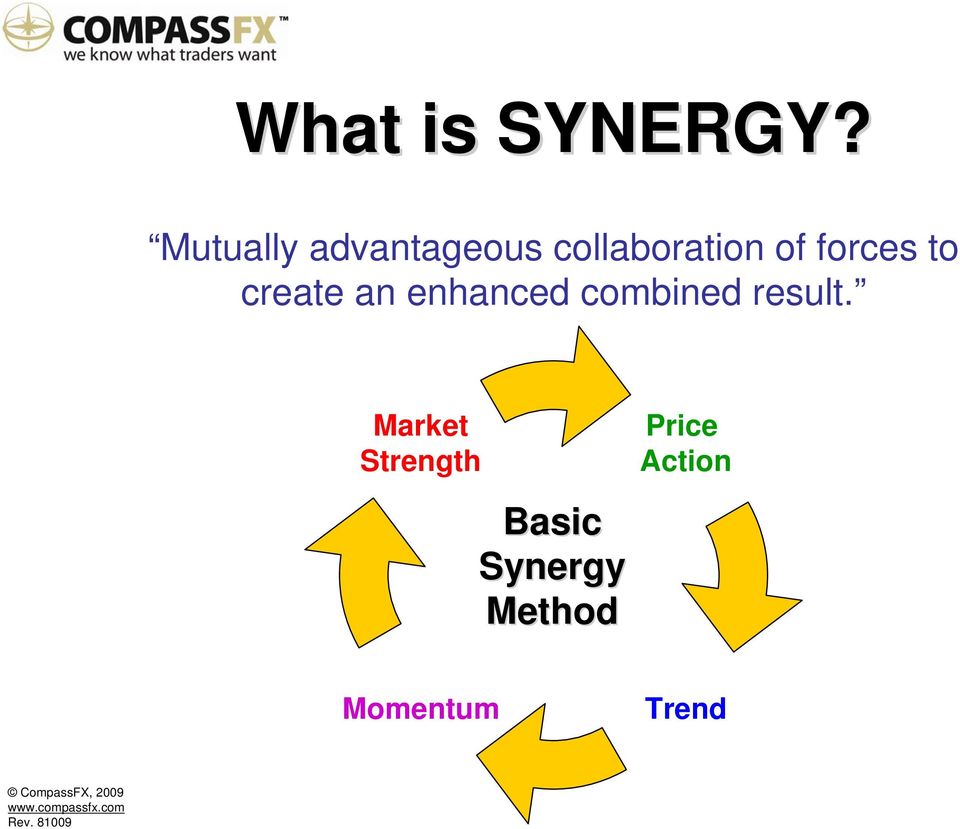

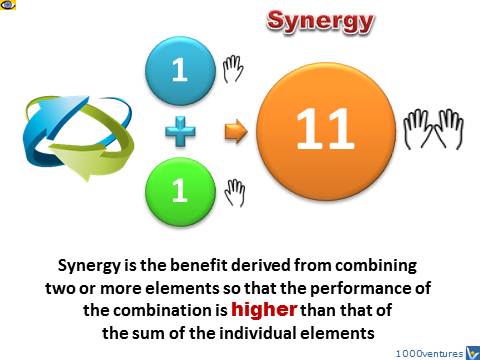

In the first example, there are probably some benefits associated with gaining those five new alliances, or eliminating redundancies in the five alliances in the second case. I can acquire you now and be the only firm in control of those five alliance relationships. What that means is that your five partners are the same as my five partners. Or let’s say my company and your company each have five alliances. So I could acquire you, and if I inherit those five alliances that you had, I’m going to generate a new network that now has 10 alliances. Let’s say my company has five alliances and your company has its own five alliances with other firms that I don’t have alliances with. Hernandez: A network synergy we define as the value or the benefit that an acquirer can get from combining its network of alliance partners with the network of alliance partners of a target firm. What my coauthors did was combine those two ideas and ask a question that had never been asked before, which is this: Could synergies come from combining the alliance networks by acquiring a target? We called those synergies “network What is the importance of network synergies, and how is it different from what you described as corporate or internal synergies? “We wanted to know whether firms make acquisitions to get these network synergies.” I started wondering whether they would be valuable when firms are choosing to do mergers and acquisitions, even if they don’t own and control those relationships. But I was surprised that they overlooked these alliance networks. Think machinery, or patents, or teams and people, or rights over markets. Synergy is just when the combination of the two firms or the assets of the two firms is more valuable put together than separate.īut what I noticed is that managers and researchers had focused on synergies coming from assets that the two companies own and control. And we know from literature - whether it’s academic literature or just talking with managers - that value in mergers and acquisitions happens through synergy. Secondly, another thing that firms do all the time is mergers and acquisitions. Or if your firm is exposed to a lot of different ideas through the network, it will produce more innovative products. And research has shown before that how a firm is positioned in that network is valuable.įor example, if your firm is a central hub in an alliance network, it gets more resources and controls the flow of those resources. Each of those alliances on its own has a certain value, but most important is that the portfolio of alliances of a company is valuable because it’s a network of external resources. The first is that we’ve known for quite a long time now that strategic alliances or collaborative partnerships with other companies are valuable.įor example, firms collaborate all the time to do R&D or share knowledge or commercialize a product, etc. Zeke Hernandez: For a long time, I had been interested in two things that companies do all the time, but nobody had really put them together. (Listen to the podcast at the top of the page.)Īn edited transcript of the conversation Can you tell us more about your research? How did you pick this topic, and what did you set out to discover?

Hernandez recently spoke with to discuss the two papers’ complementary research. Myles Shaver and “ Acquisitions, Node Collapse, and Network Revolution,” by Hernandez and fellow Wharton management professor Anoop Menon.

The research papers are “ Network Synergy,” authored by Wharton management professor Exequiel (Zeke) Hernandez and University of Minnesota professor J. Two Wharton papers mine the less beaten path of network synergies - the idea that the external partnerships of the combined company prove to be more valuable than separate partnerships the two firms would have inked on their own. Research on mergers and acquisitions has typically focused on exploring internal synergies - where the deal generates value by combining the internal assets that each firm owns and controls. Why do companies choose to acquire rather than form a partnership? And when they do decide to buy another firm, what makes them choose one target over another? Wharton research reveals that companies pursue M&A when there are both internal synergies at work as well as network synergies.

0 kommentar(er)

0 kommentar(er)